Estonia Digital Nomad Taxes: Do E-Residents Pay Taxes in Estonia?

Reading time: 12 minutes

Table of Contents

- Introduction to Estonia’s E-Residency and Tax System

- E-Residency Explained: What It Is and What It Isn’t

- Tax Residency vs. E-Residency: Critical Distinctions

- Business Taxation for E-Residents with Estonian Companies

- Personal Income Taxation for E-Residents

- Digital Nomad Visa and Its Tax Implications

- Strategic Tax Planning for E-Residents

- Compliance Requirements and Reporting Obligations

- Real-World Tax Scenarios: Case Studies

- Conclusion

- Frequently Asked Questions

Introduction to Estonia’s E-Residency and Tax System

Feeling overwhelmed by the intersection of digital nomadism, e-residency, and Estonian taxation? You’re in good company. Estonia’s pioneering e-residency program has attracted over 94,000 digital entrepreneurs from 179 countries since its launch in December 2014, creating a new paradigm for location-independent business operations.

Let’s cut through the confusion: E-residency offers remarkable business opportunities, but its tax implications are frequently misunderstood. What began as a digital identity system has evolved into a gateway for global entrepreneurs to access the EU market, but the tax consequences aren’t always what people expect.

Here’s the reality check: E-residency doesn’t automatically make you an Estonian tax resident. In fact, most e-residents never pay personal income taxes to Estonia. Understanding this distinction is crucial for proper tax planning and compliance.

As Ott Vatter, former Managing Director of the e-Residency program, puts it: “E-residency is not a tax residency solution. It’s a business administration tool that provides access to Estonia’s digital infrastructure. Tax obligations remain primarily determined by where you physically reside and your country’s specific tax treaties.”

E-Residency Explained: What It Is and What It Isn’t

Estonia’s e-residency program represents a digital breakthrough in how entrepreneurs interact with governments, but misperceptions about what it offers are widespread.

The Fundamentals of E-Residency

At its core, Estonian e-residency provides a government-issued digital identity and status that grants access to Estonia’s transparent digital business environment. With your e-resident digital ID card, you can:

- Establish and manage an EU-based company entirely online

- Digitally sign documents and contracts

- Access banking services

- Conduct secure e-transactions

- Declare Estonian taxes online

What e-residency is not:

- Citizenship or physical residency permission

- A travel document or visa

- Automatic tax residency in Estonia

- A way to avoid taxes in your home country

Kersti Kaljulaid, former President of Estonia, clarified: “E-residency doesn’t change where you pay taxes. It simply gives you tools to run a business with minimal bureaucracy, regardless of your location.”

The Digital Identity Framework

Your e-residency digital ID card is secured with 2048-bit public key encryption—the same level of security used in Estonian internet banking. This technology allows for secure authentication and digital signatures that are legally binding throughout the EU.

Consider this scenario: Maria, a freelance developer from Argentina, applied for e-residency to access European clients more efficiently. Within weeks of receiving her digital ID, she established her Estonian company, opened a business account with an Estonian fintech, and began invoicing EU clients—all without setting foot in Estonia. While her company operations run through Estonia, Maria continues to pay her personal income taxes in Argentina, where she physically resides.

Tax Residency vs. E-Residency: Critical Distinctions

The most significant confusion surrounding Estonia’s e-residency program revolves around tax residency. Let’s clarify these crucial differences.

How Tax Residency Is Determined in Estonia

Estonian tax residency is determined primarily by physical presence, not digital status. According to Estonian tax law, you become a tax resident if either:

- Your place of residence is in Estonia (registered in the Population Register)

- You stay in Estonia for at least 183 days over 12 consecutive months

E-residency alone triggers none of these conditions. As Joel Zernask, Partner at KPMG Estonia, explains: “There’s a fundamental difference between having an Estonian digital identity and being subject to Estonian taxation. The former doesn’t automatically lead to the latter.”

International Tax Implications

Most countries determine tax residency based on:

- Physical presence (the 183-day rule)

- Permanent home availability

- Center of vital interests (personal and economic connections)

- Habitual abode

- Nationality/citizenship

E-residency doesn’t alter these criteria. If you’re physically based in Germany, Spain, or Singapore, you’ll typically remain a tax resident of that country, regardless of your Estonian e-residency status.

Consider this real-world example: Thomas, a German e-resident entrepreneur, established an Estonian OÜ (private limited company) while continuing to live in Berlin. Despite running his business through Estonia, Thomas remains a German tax resident. He must declare his worldwide income to German tax authorities, including any salary or dividends from his Estonian company.

Business Taxation for E-Residents with Estonian Companies

When e-residents establish Estonian companies, they access one of Europe’s most business-friendly tax systems. Let’s explore how this works in practice.

| Tax Feature | Estonia | EU Average | Global Average | Benefit to E-Residents |

|---|---|---|---|---|

| Corporate Income Tax on Retained Earnings | 0% | 21.5% | 23.8% | Growth capital preservation |

| Corporate Tax on Distributed Profits | 20% (or 14% for regular distributions) | 21.5% | 23.8% | Tax deferral advantage |

| VAT Registration Threshold | €40,000 annual turnover | €35,000 (varies widely) | N/A | Simplified compliance for small businesses |

| Time Required for Tax Compliance | 5-7 hours per month | 10-15 hours per month | 12-20 hours per month | Administrative efficiency |

| Digital Tax Declaration | 100% online | Partially digital | Often paper-based | Location-independent management |

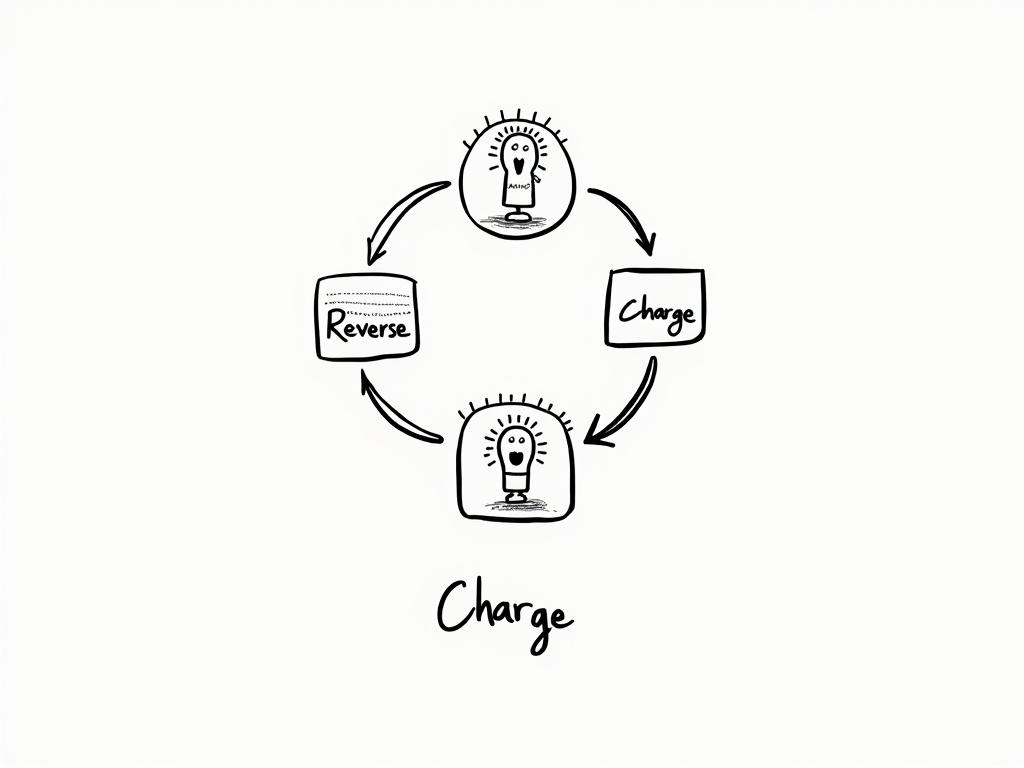

The Estonian Corporate Tax System

Estonia’s corporate taxation approach is uniquely designed around cash flow rather than accounting profits. Key features include:

- Deferred taxation: Profits are only taxed when distributed as dividends, not when earned

- Reinvestment incentive: Retained earnings can be reinvested tax-free

- Tiered dividend tax rate: 14% for regular distributions (when distributing less than or equal to the average distributed profit of the previous three years), 20% for larger or irregular distributions

- Simplified compliance: Monthly declarations only when there are taxable transactions

Kaspar Korjus, founding Managing Director of the e-Residency program, emphasizes: “Estonia’s tax system is designed to support business growth. By only taxing distributed profits, we allow companies to reinvest and scale without immediate tax pressure.”

Operational Requirements and Substance

While establishing an Estonian company is straightforward, maintaining proper business substance is essential to avoid tax complications. Estonian companies must:

- Maintain actual business operations (not serve as empty shells)

- Keep proper accounting records

- File annual reports

- Document board meetings and decisions

- Handle management activities from appropriate locations

Without adequate substance, your Estonian company risks being deemed effectively managed in your country of residence, potentially triggering taxation there.

Personal Income Taxation for E-Residents

While your Estonian company enjoys favorable tax treatment, what about your personal income? This is where many e-residents need clarity.

Salary and Dividend Taxation

If you draw income from your Estonian company, here’s how it’s taxed:

For non-tax residents of Estonia:

- Salary payments: Subject to Estonian income tax (20%) and social security contributions if work is performed in Estonia

- Dividend payments: Taxed at the corporate level (20% or 14% depending on distribution pattern); no additional withholding tax for individuals

- Note: Your country of tax residency likely requires declaration of this worldwide income

For tax residents of Estonia:

- Salary payments: Subject to Estonian income tax (20%) with a tax-free allowance of €654 monthly and social security contributions

- Dividend payments: Same as above, but must be declared on personal tax returns

- Worldwide income: Must be declared to Estonian tax authorities

Consider this example: Sofia, a Portuguese e-resident entrepreneur, runs her digital marketing agency through an Estonian OÜ while living in Lisbon. She pays herself a modest monthly salary and distributes dividends annually. The Estonian company handles the corporate tax on dividends, but Sofia must declare both her salary and dividends to Portuguese tax authorities, potentially facing additional taxation based on Portuguese tax rates.

Double Taxation Considerations

Estonia has signed double taxation treaties with over 60 countries, preventing the same income from being fully taxed twice. However, the exact mechanism varies by country:

- Tax credit method: Your country of residence taxes your global income but provides credit for taxes paid in Estonia

- Exemption method: Certain types of income taxed in one country may be exempt in the other

- Tax rate reduction: Some treaties reduce the applicable withholding tax rates

Understanding your specific country’s treaty with Estonia is essential for proper tax planning. For instance, the Estonia-Germany tax treaty applies different rules than the Estonia-UK treaty, potentially resulting in significantly different tax outcomes for e-residents from these countries.

Digital Nomad Visa and Its Tax Implications

In August 2020, Estonia launched its Digital Nomad Visa, adding another layer to its digital-friendly ecosystem. This visa allows remote workers to legally stay in Estonia for up to 12 months while working for foreign employers or their own non-Estonian companies.

Visa Requirements and Benefits

The Digital Nomad Visa has several key requirements:

- Proof of remote work capability

- Minimum monthly income of €3,504 (gross)

- Active employment contract with a foreign company, client contracts, or business ownership outside Estonia

- Health insurance valid in Estonia

While this visa offers the ability to legally reside in Estonia, it’s designed specifically not to create Estonian tax residency in most cases.

The 183-Day Threshold and Tax Planning

Digital nomad visa holders who stay in Estonia for fewer than 183 days within a 12-month period typically do not become Estonian tax residents. This intentional design allows digital nomads to maintain their original tax residency while legally residing in Estonia.

Ruth Annus, Head of the Estonian Interior Ministry’s Citizenship and Migration Policy Department, clarifies: “The digital nomad visa is designed to attract global talent to Estonia without necessarily shifting their tax obligations. Most visa holders will continue paying taxes in their country of tax residence rather than Estonia.”

However, digital nomads must carefully track their days in Estonia and other countries to manage their global tax position. Staying longer than 183 days could trigger Estonian tax residency, creating complex tax situations.

Strategic Tax Planning for E-Residents

Navigating the intersection of e-residency and taxation requires strategic planning. Here are key approaches to optimize your tax position legally and ethically.

Legitimate Business Structuring

Effective tax planning for e-residents typically involves:

- Salary optimization: Balancing salary withdrawals against dividend distributions

- Strategic profit distribution: Utilizing the lower 14% tax rate for regular dividend patterns

- Expense management: Properly documenting business expenses to ensure deductibility

- Reinvestment planning: Leveraging Estonia’s 0% tax on retained earnings for business growth

Martin, a UK-based software developer, structures his Estonian company’s finances by taking a modest monthly salary (subject to UK taxes) while retaining most profits in the company for reinvestment. When he does distribute dividends, he maintains a consistent pattern to qualify for the lower 14% Estonian corporate tax rate. This approach legally minimizes his immediate tax burden while supporting business growth.

Common Pitfalls to Avoid

While optimizing your tax position is legitimate, certain approaches can trigger audits or penalties:

- Artificial arrangements: Creating business structures without economic substance

- Permanent establishment risks: Inadvertently creating a taxable presence in your country of residence

- Non-declaration of worldwide income: Failing to report Estonian company income to your home country

- Transfer pricing issues: Incorrect pricing of transactions between related entities

Estonian tax authorities increasingly collaborate with other countries through automatic information exchange agreements, making transparency and compliance essential.

Compliance Requirements and Reporting Obligations

Maintaining proper compliance is crucial for e-residents operating Estonian companies. Let’s examine the key requirements.

Record-Keeping and Declarations

Estonian companies must maintain:

- Proper accounting records (typically using Estonian-compatible accounting software)

- Documentation of business transactions and contracts

- Annual reports filed within 6 months of the financial year-end

- Monthly tax and social security declarations (when applicable)

- VAT returns (monthly or quarterly) for VAT-registered companies

While Estonian business administration is highly digital, compliance requirements remain robust. Most e-residents work with Estonian accounting firms to ensure proper compliance, typically costing €100-300 monthly depending on transaction volume and complexity.

International Reporting Obligations

E-residents must also consider:

- Controlled Foreign Corporation (CFC) rules in their country of residence

- Beneficial ownership registrations

- Foreign account reporting requirements (like FBAR for US citizens)

- Country-by-country reporting for larger enterprises

The global implementation of the OECD’s Common Reporting Standard means financial information is automatically exchanged between tax authorities, creating a transparent environment where proper reporting is essential.

Real-World Tax Scenarios: Case Studies

To better understand how Estonian e-residency and taxation work in practice, let’s examine two detailed case studies.

Case Study 1: The EU-Based Digital Consultant

Anna is a digital marketing consultant from Germany who established an Estonian OÜ through e-residency while continuing to live in Berlin. Her tax situation breaks down as follows:

Business Setup and Operations:

- Estonian OÜ handles all client contracts and invoicing

- Company maintains a business account with an Estonian fintech

- Annual turnover: €120,000

- Business expenses: €30,000

- VAT-registered in Estonia (charging 20% Estonian VAT to EU B2C clients, 0% to EU B2B clients with valid VAT numbers)

Income Structure:

- Monthly salary: €2,500 (€30,000 annually)

- Annual dividend: €30,000

- Retained earnings: €30,000

Tax Implications:

- Salary is subject to German income tax and social security (as she performs the work in Germany)

- Estonian company pays 14% corporate tax on dividends (€4,200)

- Anna declares the dividend income on her German tax return

- No Estonian tax on retained earnings

- German CFC rules potentially apply if Anna doesn’t demonstrate sufficient business substance in Estonia

Anna’s key tax challenge is demonstrating that her Estonian company has genuine economic substance and is not merely a shell to avoid German taxation. She addresses this by periodically working from Estonia, maintaining proper board documentation, and ensuring her company serves multiple clients rather than just one.

Case Study 2: The Non-EU Digital Nomad

James is an Australian web developer who frequently travels while working remotely. He established an Estonian company through e-residency to serve EU clients and obtained Estonia’s digital nomad visa for a 10-month stay in Tallinn.

Business and Residency Structure:

- Estonian OÜ for client contracts and invoicing

- Travels 4-5 months annually, never exceeding 183 days in any single country

- Spent 10 months in Estonia on a digital nomad visa

- Annual turnover: €90,000

- Business expenses: €20,000

Income Structure:

- Quarterly board member fee: €3,000 (€12,000 annually)

- Annual dividend: €40,000

- Retained earnings: €18,000

Tax Implications:

- Board member fees are subject to 20% Estonian withholding tax (€2,400 annually)

- Estonian company pays 20% corporate tax on dividends (€8,000) as this is a first-time distribution

- No Estonian tax on retained earnings

- Potentially no clear tax residency due to nomadic lifestyle (tax residency risks in Australia if ties remain strong)

- Must carefully document physical presence in each country to manage tax residency status

James’s situation highlights the complexity of taxes for true digital nomads. While his Estonian company structure works well for business operations, his personal tax residency situation requires careful management to avoid either double taxation or unintentional tax avoidance.

Conclusion

Estonia’s e-residency program offers a powerful digital framework for global entrepreneurs, but it’s not a tax residency solution or tax avoidance tool. The key takeaways for e-residents navigating taxation include:

- E-residency and tax residency are entirely separate concepts with different criteria and implications

- Most e-residents remain tax residents of their home countries, where they must declare worldwide income

- Estonian companies benefit from 0% tax on retained earnings, but distributed profits face corporate taxation

- Proper business substance and compliance are essential to avoid complications with tax authorities

- Strategic, legitimate tax planning can optimize your position while maintaining full compliance

As Siim Sikkut, former Government CIO of Estonia, notes: “E-residency was designed to remove location as a barrier to entrepreneurship, not to create tax advantages. Its true value lies in accessibility, efficiency, and digital convenience.”

The successful e-resident approach to taxation combines taking advantage of Estonia’s business-friendly environment while maintaining proper compliance with personal tax obligations in your country of residence. With this balanced approach, Estonian e-residency can indeed serve as a powerful tool for global entrepreneurs seeking efficiency and digital freedom.

Frequently Asked Questions

If I become an Estonian e-resident, does that make me tax-exempt in my home country?

No. E-residency has no impact on your personal tax residency status. Most countries determine tax residency based on physical presence (typically the 183-day rule), permanent home, or center of vital interests. You remain obligated to declare worldwide income, including income from your Estonian company, to your home country’s tax authorities. E-residency is a digital identity that enables business administration, not a tax planning tool that changes your tax residency status.

How can I determine if my business activities might create a permanent establishment issue in my country of residence?

Permanent establishment risks typically arise when your business activities in your country of residence exceed certain thresholds. Key warning signs include: maintaining a fixed place of business (office, workshop) in your home country; regularly concluding contracts there on behalf of your Estonian company; having employees working permanently in your country; or if your Estonian company appears to be managed entirely from your country of residence. To mitigate these risks, consider periodically working from Estonia, maintaining proper board documentation in Estonia, diversifying your client base, and consulting with a tax professional familiar with both jurisdictions.

What happens if I start spending more than 183 days per year in Estonia as an e-resident?

If you spend more than 183 days in Estonia within any 12-month period, you’ll likely become an Estonian tax resident. This means you must declare and pay taxes on your worldwide income to Estonian tax authorities (not just income from your Estonian company). You’ll benefit from Estonia’s personal income tax system, including the standard tax-free allowance of €654 monthly, but will face the 20% flat tax rate on income exceeding this threshold. This situation could create complex tax scenarios with your original country of residency, potentially requiring tax treaty applications to avoid double taxation. If you plan to stay in Estonia long-term, consider formal residency registration and consult with a tax advisor to manage the transition properly.