Reverse Charge Mechanism in Poland: A Comprehensive Guide for Businesses

Reading time: 12 minutes

Table of Contents

- Introduction to the Reverse Charge Mechanism

- Understanding the Basics

- When Does Reverse Charge Apply in Poland?

- Specific Goods and Services Subject to Reverse Charge

- Compliance Requirements and Documentation

- Practical Implementation for Businesses

- Common Challenges and Solutions

- International Transactions and Reverse Charge

- Conclusion

- Frequently Asked Questions

Introduction to the Reverse Charge Mechanism

Feeling perplexed by Poland’s reverse charge mechanism? You’re in good company. This VAT accounting procedure shifts tax liability from seller to buyer, transforming how businesses manage their tax obligations across various sectors. While seemingly technical, mastering this system can substantially impact your business operations and bottom line.

The reverse charge mechanism was introduced as a strategic measure to combat VAT fraud—particularly carousel fraud—where businesses exploit cross-border transactions to claim VAT refunds fraudulently. By shifting the tax liability to the recipient, Poland has significantly reduced opportunities for such schemes while simplifying certain business transactions.

Let’s cut to the chase: understanding when and how the reverse charge applies isn’t just about compliance—it’s about strategic financial management. Get it right, and you’ll optimize cash flow, reduce administrative burdens, and minimize tax-related risks.

Understanding the Basics

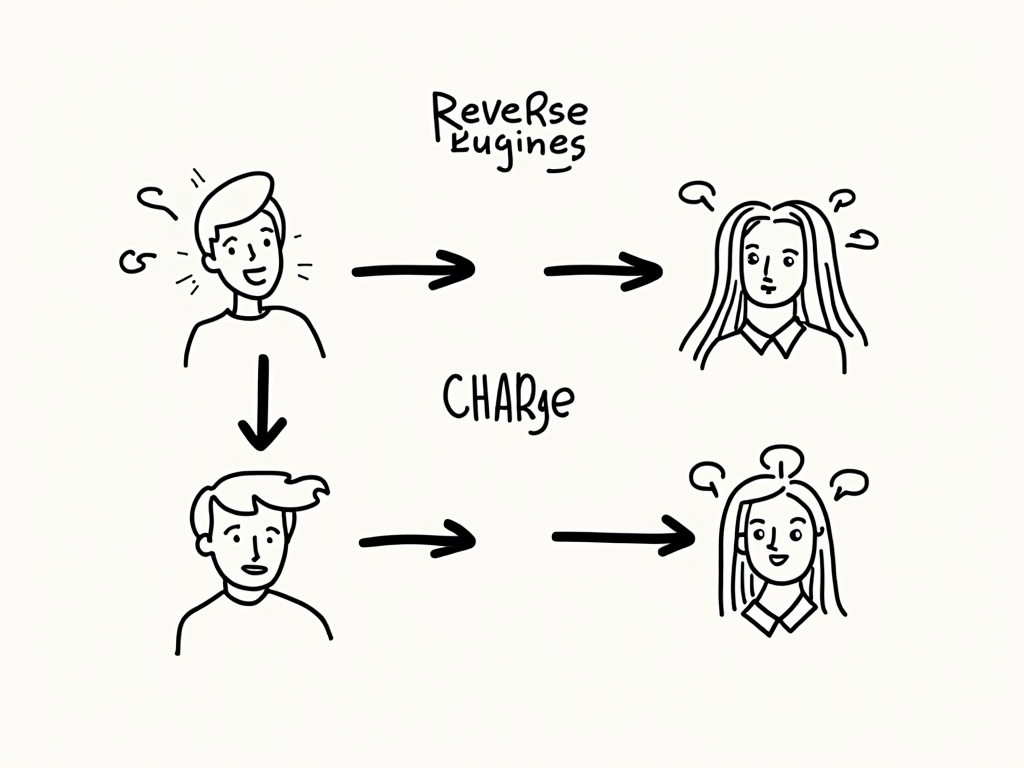

At its core, the reverse charge mechanism flips the standard VAT collection process. Under normal circumstances, the seller charges VAT on goods or services and remits it to tax authorities. With reverse charge, the buyer assumes responsibility for accounting for and paying the VAT.

How Does Reverse Charge Differ from Standard VAT?

Think of standard VAT as a relay race where each participant (business) collects the baton (VAT) and passes it forward until it reaches the final consumer. The reverse charge mechanism, however, works more like a direct handoff:

- Standard VAT Process: Seller issues invoice with VAT → Buyer pays invoice including VAT → Seller remits VAT to tax authorities → Buyer claims VAT deduction

- Reverse Charge Process: Seller issues invoice without VAT (but indicating reverse charge) → Buyer pays invoice without VAT → Buyer calculates VAT and simultaneously records it as both output and input VAT

This subtle yet significant difference creates a cash-neutral VAT transaction for the buyer while eliminating the need for the seller to collect and remit VAT.

The Legal Framework in Poland

Poland’s reverse charge provisions are governed primarily by the Polish VAT Act (Ustawa o podatku od towarów i usług), which aligns with the EU VAT Directive 2006/112/EC. The mechanism has undergone several amendments since Poland joined the European Union in 2004, with significant updates in 2011, 2015, 2017, and 2019.

As Marta Kowalska, Tax Partner at Warsaw Tax Advisory, puts it: “Poland’s implementation of the reverse charge mechanism represents one of the most comprehensive applications in the EU, covering both domestic and cross-border scenarios with explicit focus on high-risk sectors.”

When Does Reverse Charge Apply in Poland?

The reverse charge mechanism in Poland applies in two primary scenarios: domestic transactions involving specified goods and services, and cross-border transactions within the European Union.

Domestic Transactions

Within Poland, reverse charge applies to specific categories of goods and services that have been identified as high-risk for VAT fraud. The mechanism kicks in when:

- The transaction involves designated goods or services (detailed in the next section)

- Both parties are VAT-registered businesses

- The transaction occurs within Polish territory

Here’s a practical scenario: A Polish construction company provides renovation services to a commercial property owner. Since construction services fall under the reverse charge in Poland, the construction company issues an invoice without VAT but with a note stating “reverse charge.” The property owner then accounts for VAT in their return as both output and input tax.

Cross-Border Transactions

For transactions crossing borders within the EU, the reverse charge applies more broadly to:

- Intra-Community acquisition of goods (purchases from other EU countries)

- Services received from suppliers established in other EU countries (under the general B2B rule)

- Certain imported services from non-EU countries

Consider this example: A manufacturing company in Warsaw purchases consulting services worth 10,000 EUR from a German firm. Instead of the German company charging German VAT, it issues a zero-rated invoice. The Polish company then self-accounts for Polish VAT at 23% (2,300 EUR) as both output and input tax in its VAT return.

Specific Goods and Services Subject to Reverse Charge

Poland has designated specific categories of goods and services where the reverse charge must be applied in domestic transactions. Understanding these categories is crucial for proper tax compliance.

Goods Subject to Reverse Charge

The following goods fall under the domestic reverse charge mechanism when traded between VAT-registered businesses in Poland:

- Metal products – including copper, steel, aluminum products, and scrap metal

- Electronic components – particularly processors, mobile phones, laptops, tablets, and gaming consoles

- Construction materials – certain types as specified in the VAT Act

- Carbon emission allowances

- Specific agricultural products – including certain grains and oilseeds

It’s worth noting that for electronic goods, the reverse charge applies only when the transaction value exceeds 20,000 PLN.

Services Subject to Reverse Charge

The service categories subject to reverse charge in Poland include:

- Construction services – including renovation, repair, and installation

- Specific labor services – such as the provision of construction or manufacturing personnel

- Greenhouse gas emission allowance trading

- Real estate services – under certain conditions

The construction sector provides the most illustrative example of reverse charge application. As Jan Nowak, a construction company owner, explains: “When my company handles large commercial renovations, we operate entirely under the reverse charge. It’s dramatically improved our cash flow since we no longer have to finance VAT payments while waiting for client payments.”

Compliance Requirements and Documentation

Correct documentation and reporting are essential aspects of reverse charge compliance in Poland. Missteps here can lead to tax assessments, penalties, and administrative headaches.

Invoice Requirements

When issuing an invoice under the reverse charge mechanism, you must include:

- The phrase “reverse charge” (odwrotne obciążenie) clearly stated on the invoice

- The legal basis for applying reverse charge (relevant article of the VAT Act)

- The tax identification numbers (NIP) of both parties

- A clear indication that the invoice is issued without VAT

- The statement “VAT to be accounted for by the purchaser” or similar wording

Pro Tip: Many accounting software packages can be configured to automatically generate compliant reverse charge invoices once you select the appropriate transaction type.

VAT Registration and Reporting

Both parties involved in a reverse charge transaction must:

- Be registered for VAT purposes in Poland

- Properly report reverse charge transactions in their regular VAT returns

- For certain transactions, include details in supplementary VAT reports (JPK_VAT)

The buyer must account for both output VAT (tax due) and input VAT (tax deductible) in the same VAT return period, typically resulting in a zero net tax effect if they have full VAT recovery rights.

| Aspect | Standard VAT Transaction | Reverse Charge Transaction |

|---|---|---|

| Invoice VAT | VAT charged by seller | No VAT charged, noted as “reverse charge” |

| Cash Flow Impact | Buyer pays VAT to seller, later recovers | No VAT payment to seller, cash-neutral transaction |

| Seller Reporting | Reports as output VAT | Reports as net sales without VAT |

| Buyer Reporting | Reports as input VAT | Reports as both output and input VAT (same amount) |

| Risk of Missing Trader Fraud | Higher risk | Significantly reduced risk |

Practical Implementation for Businesses

Implementing the reverse charge mechanism effectively requires strategic planning and proper systems. Let’s explore how businesses can streamline this process.

Setting Up Accounting Systems

Your accounting system should be configured to:

- Flag transactions that qualify for reverse charge treatment

- Generate compliant invoices with appropriate notations

- Automatically calculate and record both output and input VAT for reverse charge transactions

- Produce accurate data for VAT returns and JPK_VAT files

Many Polish businesses have found success with accounting systems like Comarch Optima, Sage Symfonia, or SAP, which have specific Poland VAT modules designed to handle reverse charge transactions correctly.

Cash Flow Planning

The reverse charge can significantly impact business cash flow—usually positively for buyers but requiring adjustment for sellers. Here’s how to adapt:

For Buyers:

- Recognize the cash flow advantage of not paying VAT upfront

- Adjust financial forecasting to account for reverse charge transactions

- Consider the timing of large purchases to optimize cash management

For Sellers:

- Adjust pricing strategies to account for the loss of cash flow timing advantage

- Review contract terms to ensure they address reverse charge conditions

- Consider impacts on working capital requirements

Robert Wiśniewski, CFO of a medium-sized electronics distributor in Wrocław, shares this insight: “When we first encountered the reverse charge on our electronic component sales, we had to completely rethink our working capital needs. We no longer had the float period of holding VAT before remitting it to tax authorities. It prompted us to negotiate better payment terms with our suppliers.”

Common Challenges and Solutions

Despite its advantages, the reverse charge mechanism presents certain challenges. Here’s how to navigate the most common ones.

Determining When Reverse Charge Applies

The most frequent challenge is simply determining when to apply the reverse charge, especially for businesses dealing with a variety of goods and services.

Challenge: The electronics distributor Techmex received an order for mixed items, some subject to reverse charge and others not.

Solution: Techmex implemented a product coding system that automatically flags items subject to reverse charge. For mixed orders, they issue separate invoices: one for standard VAT items and another for reverse charge items. This practice, while creating more paperwork, ensures compliance and clarity.

Cross-Border Complexity

Transactions involving multiple countries can create confusion about which country’s reverse charge rules apply.

Challenge: A Polish architectural firm provided design services for a building in Germany, contracted by an Italian company with a German VAT registration.

Solution: The firm consulted a tax advisor who confirmed that since the service related to immovable property, the place of supply was Germany. They issued an invoice without Polish VAT, and the Italian company accounted for German VAT under the German reverse charge rules. The Polish firm also documented the transaction with contracts specifying the location of services to support their VAT treatment.

Audit Defense Strategies

Tax audits focusing on reverse charge transactions are common in Poland. Preparation is key:

- Maintain comprehensive documentation showing why reverse charge was applied or not applied

- Keep evidence of buyer’s VAT registration status at transaction time

- Document the nature of goods/services to justify classification

- Consider obtaining written tax rulings for complex or high-value recurring transactions

As Anna Kowalczyk, a tax advisor specializing in VAT audits, advises: “The best defense in a reverse charge audit is systematic documentation. Polish tax authorities look for consistency in your approach and evidence that you’ve done due diligence in determining the correct VAT treatment.”

International Transactions and Reverse Charge

For businesses engaged in international trade, understanding the interaction between Polish reverse charge rules and international VAT principles is crucial.

EU Transactions

When dealing with other EU countries, Polish businesses need to navigate several scenarios:

- Intra-Community Acquisitions: When a Polish company purchases goods from another EU country, reverse charge automatically applies

- Intra-Community Services: For most B2B services, the place of supply is where the customer is established, triggering reverse charge

- Triangulation: Special simplified rules apply when three VAT-registered businesses in different EU countries are involved in a single transaction

For example, a Polish manufacturing company orders machinery from a German supplier, but requests delivery directly to their factory in Czech Republic. This triangulation can be handled through simplified procedures where the Polish company applies reverse charge without needing Czech VAT registration.

Non-EU Transactions

Transactions with non-EU countries follow different rules:

- Imported Goods: Import VAT is generally paid at customs, though certain authorized businesses can apply postponed accounting similar to reverse charge

- Services from Non-EU Providers: When Polish businesses receive services from non-EU providers that are taxable in Poland, reverse charge typically applies

Magdalena Nowak’s software development company in Kraków regularly purchases cloud services from US providers. She explains: “We account for these services under reverse charge, declaring and deducting the VAT simultaneously in our Polish VAT return. It’s simpler than having our international providers register for Polish VAT, which they would likely refuse to do anyway.”

Conclusion

The reverse charge mechanism in Poland represents a significant but navigable aspect of the VAT system. When properly understood and implemented, it offers notable benefits: improved cash flow for purchasers, reduced fraud risk across supply chains, and simplified compliance for cross-border transactions.

Success with the reverse charge mechanism ultimately depends on three key practices:

- Diligent classification of transactions to correctly identify reverse charge scenarios

- Proper documentation through compliant invoices and supporting evidence

- Accurate reporting in VAT returns and supplementary declarations

Rather than viewing the reverse charge as merely a technical compliance requirement, forward-thinking businesses recognize it as a strategic opportunity to optimize tax processes and cash flow management. By mastering these rules, your business can turn tax complexity into a competitive advantage in the Polish market.

Remember: The reverse charge landscape continues to evolve. The Polish Ministry of Finance regularly updates the scope of transactions covered by domestic reverse charge provisions, making ongoing attention to regulatory changes an essential part of your tax compliance strategy.

Frequently Asked Questions

What penalties apply for incorrect application of reverse charge in Poland?

Incorrectly applying (or failing to apply) the reverse charge can result in significant penalties in Poland. These typically include assessment of unpaid VAT plus interest (currently approximately 8% per annum), potential additional tax sanctions of 20-30% of the tax underpayment in cases of gross negligence, and in extreme cases of deliberate fraud, criminal liability with fines up to 720 daily rates and potential imprisonment. However, if you discover and correct errors voluntarily before tax authorities identify them, you can typically avoid the additional sanctions by filing a correction and paying any tax due plus interest.

Can foreign businesses with Polish VAT registration use the reverse charge mechanism?

Yes, foreign businesses registered for VAT in Poland can both issue and receive invoices under the reverse charge mechanism, provided the transaction meets all required conditions. In fact, for non-established businesses conducting taxable transactions in Poland, the reverse charge is often preferable as it eliminates the need to recover Polish VAT through refund procedures. However, for domestic transactions subject to reverse charge, the foreign business must verify that both parties are VAT-registered in Poland and that the specific goods or services fall within designated categories. For services received from abroad, a foreign business with Polish VAT registration must apply reverse charge following the same rules as Polish-established entities.

How do partial exemption rules interact with reverse charge in Poland?

For partially exempt businesses in Poland (those that cannot fully recover input VAT), the reverse charge mechanism creates a unique situation. When such businesses receive supplies under reverse charge, they must still account for the full output VAT, but can only recover the input VAT according to their recovery percentage or specific attribution rules. This means the transaction is no longer cash-neutral. For example, if a bank in Poland (typically having a low VAT recovery rate) receives construction services under reverse charge, it must account for 23% VAT as output tax but might only be able to reclaim 5-10% as input tax, creating an effective cost of 13-18% on the transaction. Partially exempt businesses should carefully model the VAT cost impact of reverse charge purchases during budgeting and procurement planning.